51+ how much of your income should go towards mortgage

Save Real Money Today. Calculate Your Monthly Loan Payment.

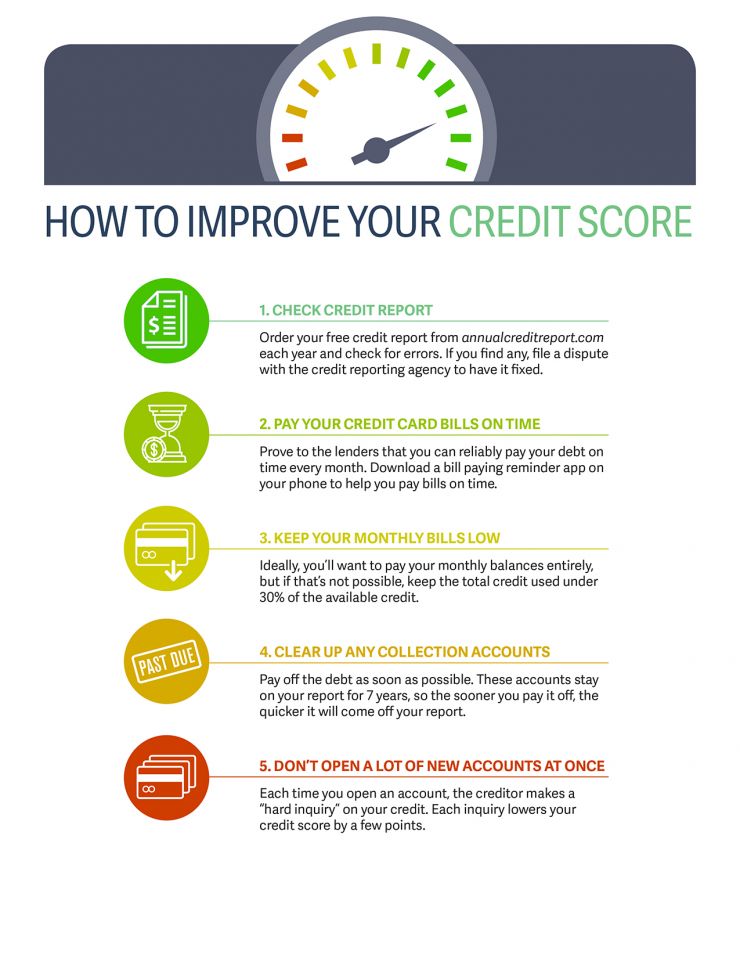

How To Improve Your Credit Score Sun Federal Credit Union

Web A 15-year term.

. This means that if your household brings in. Easily Compare Mortgage Rates and Find a Great Lender. John in the above example makes.

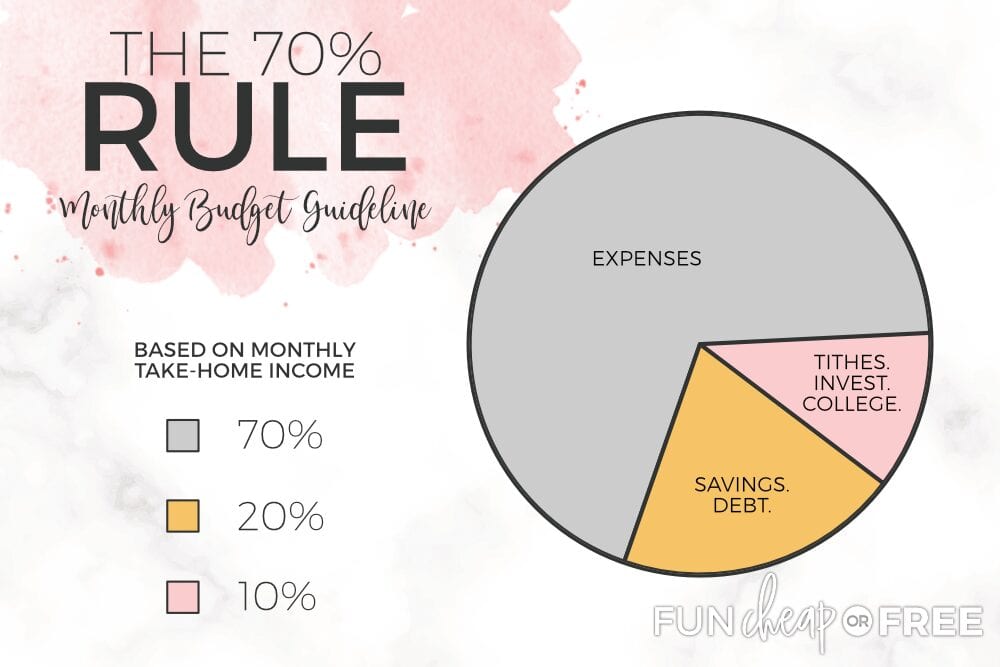

This rule says that you should not spend more than 28 of. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. So for example if your monthly income.

Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford.

Lock Your Mortgage Rate Today. It Pays To Compare Offers. Apply Now With Quicken Loans.

Ad Compare Mortgage Options Calculate Payments. Were Americas Largest Mortgage Lender. Generally speaking most prospective homeowners can afford to finance a property that costs between two and two-and-a-half.

Thats a mortgage between 120000 and. Find The Right Mortgage For You By Shopping Multiple Lenders. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income.

Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most. Ad First Time Home Buyer. Web Finally the 25 post-tax model says that your total monthly debt should be 25 or less of your monthly post-tax income.

Web A good rule of thumb is that your mortgage payments should be no more than 25 percent of your monthly income. Web How Much Mortgage Can I Afford. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your.

Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Ad See If Youre Eligible for a 0 Down Payment. However how much you.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility.

And you should make. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

Credit Score Needed To Buy A House Nexum Group Inc Florida Debt Collection Agency

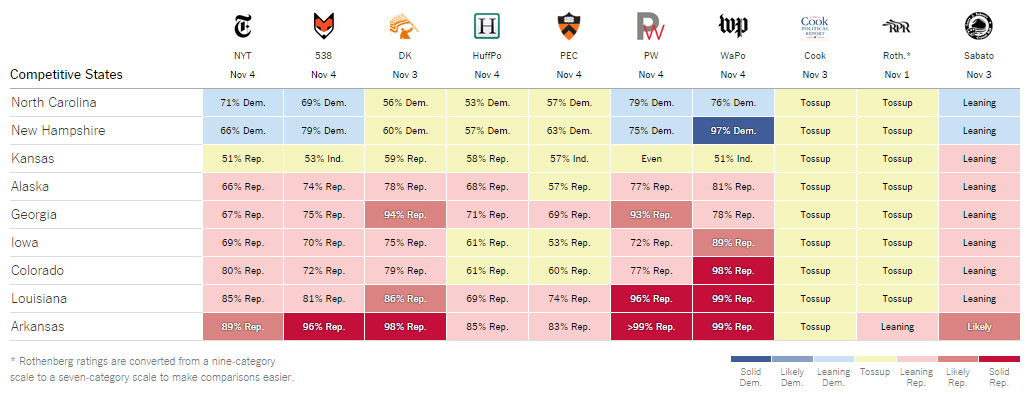

Princeton Election Consortium

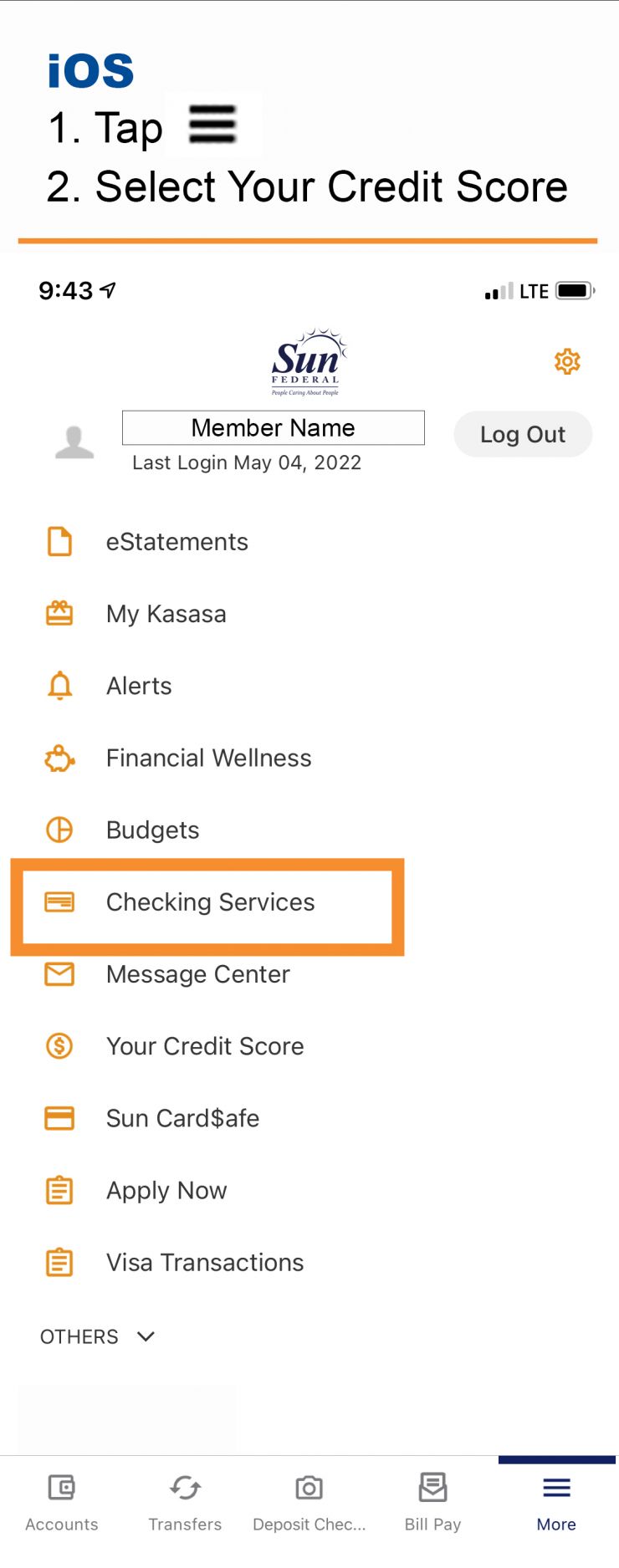

Your Credit Score

How Much To Spend On A Mortgage Based On Salary Experian

126k 31 28 No

Moneybrag Blog How Much House Can You Afford

Covid 19 Government Financial Assistance And Insurance Premium Deferrals For Physicians Levine Financial Group

What Percentage Of Income Should Go To Mortgage Morty

The Percentage Of Income Rule For Mortgages Rocket Money

47 Sample Credit Agreements In Pdf Ms Word

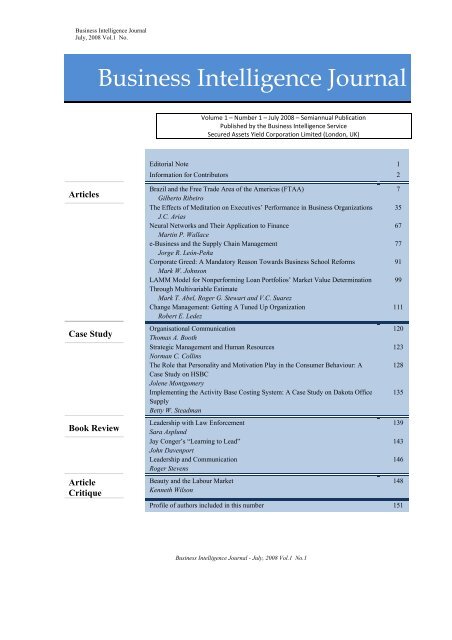

Business Intelligence Journal Sayco

What Percentage Of Income Should Go To A Mortgage Bankrate

Brac Bank Payment Retail Loan By Md Papon Issuu

How To Start A Life Coaching Business Thebrandboy

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

How To Find Out If You Can Afford Your Dream Home